Wealthfront

Lowest cost robot investing

I’ve moved most of my investment money into robo investors.

For the past several decades index funds have outperformed over 80 percent of actively managed funds. Index funds are cheap to run because they are simply a large group of representative stocks that an investor holds — there are no human pickers or human traders. Their yield is equivalent to the yield of “the market” so their financial performance is the market performance, but unlike actively managed funds, they have miniscule fees. If you are patient, inexpensive index funds will give the best total yield on average over the long term, taking into account their extremely low fees. Wise financial advisers have long recommended holding index funds as the best course for most people.

Now with the advent of artificial intelligence these plain unexciting index funds have become smarter and even more profitable. Some of the added value services that trained (and expensive) human advisors could do with funds, can now be done by machines, faster, better and cheaper. This so-called robo investing will automate such fancy operations as rebalancing portfolios in real time, reinvesting dividends at the ideal time, and optimizing tax-loss harvesting. These additional investment techniques, once only available to high net worth accounts, add a few points added yields and can now be applied to any account, including cheap index funds.

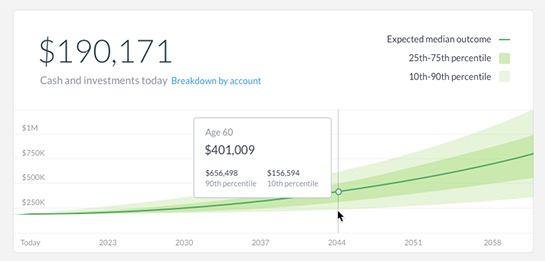

There are a couple of Silicon Valley startups running multi-billion dollar index funds enhanced with AI, such as Betterment and Wealthfront. I’ve been using Wealthfront, one the leaders, because of its easy interface. It’s performance success is directly coupled with the market ups and downs (like most index funds), but its AI algorithms add a few more percentage points gain overall, which compound over years, can be significant.

As this method is proven by these startups, you can expect the bigger established investment firms to start offering similar AI-enhanced services. For the time being Wealthfront is out-innovating the established firms, giving me better returns with very little added risk (within the equities market).

04/20/17