Global Mall Development Trends

Ask

Update on mall building rates? US? Globally? Developing world?

Trends in mall development

Results

Global Mall Construction Rates

In 2016, global shopping center completions were up 11.4% over 2015 levels, despite having slowed over the past few years.

However, the pace of development continues to slow, with the number of shopping centers under construction down 22%

The majority of added shopping center space came to market in Asia, but The Americas registered the strongest growth, with completion levels up 43.6%, fueled by construction growth in Mexico.

Src:

CBRE via Malls.com, May 2017

*

In 2016:

17% of retailers planned to open more than 40 stores

67% planned to open no more than 20

Most popular formats for expansion

76% street shops

72% regional shopping malls

45% open air shopping malls

20% transport hubs (airport, railway terminals)

18% outlets

18% retail park

15% concession counters in department stores

8% duty free

src:

CBRE Research, April 2016

“How Active Are Retailers Globally?”

*

Global shopping centre completions started to slow (in 2015) as parts of the global retail market witness the effects of an imbalance between significant supply and demand.

Despite this, there continues to be exceptional levels of construction, particularly in Asia. Globally, 10.7 million sq m of new space opened in 2015 in the 168 cities we surveyed; this is down on 2014, where 12.1 million sq m of space were completed; and a further 41.9 million sq m is under construction, up from 39 million in 2014.

src:

CBRE, April 2016

Global Retail ViewPoint – Shopping Centre Development April 2016

[full report here]

Discussion of the above CBRE report is available here.

*

Global Retail Development Index

Shows where retail investment has been most attractive (ranks top 30 countries). These are the top 10 countries in 2017

India 71.7

growing middle class, rapidly increasing consumer spending, overtakes China

China 70.4

market is maturing, still leading in e-commerce

Malaysia 60.9

good long-term prospects bc of tourists, higher disposable income, govt investments

Turkey 59.8

moved up two places

United Arab Emirates 59.4

most attractive market in the region

Vietnam 56.1

moves ahead, important market for retail expansion with its liberalized investment laws

Morocco 56.1

continues to rise in rankings, govt efforts to attract foreign investment

Indonesia 55.9

continued liberalization and infrastructure investments

Peru 54

outperforms other regional economies, two decades of solid growth

Colombia 53.6

despite lower than expected GDP growth, still attractive for retailers

src:

ATKearney, 2017

The 2017 Global Retail Development Index™

CC’s note: These rankings are available back to 2004. Could aggregate, if this were of interest to KK. (Started to aggregate a couple years’ of data, but stopped bc I wasn’t sure if it was of interest.)

Relig-Shop-Dev-Homes-Extrapolations.xlsx

GRDI tab

European Mall Construction Rates

In 2016, European shopping center construction was down 6% overall compared with 2015. Western Europe saw an increase of 15% in new shopping center completions, but this was outweighed by a 17% decline in the UK, as well as a 17% decline in Central and Eastern Europe (which also dropped 11% in 2015). Further declines are expected in 2017.

src:

Cushman & Wakefield, May 2017

“European Shopping Centers: The Development Story”

[full report behind paywall]

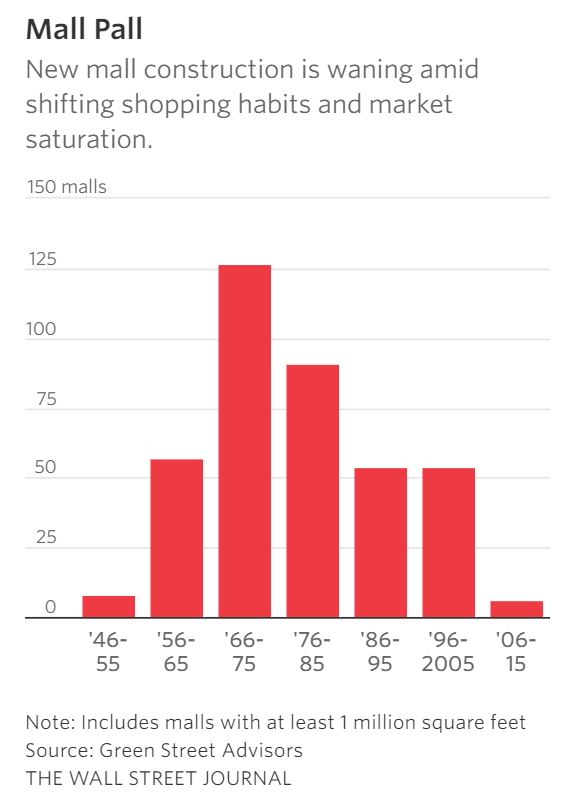

US Mall Construction Rates

U.S. mall development peaked in the 1970s and has steadily declined. Just six large malls were built between 2006 and 2015, compared with 54 during the previous decade, according to Green Street.

src:

Wall Street Journal, Oct 2017

“Big Mall Operator Does the Unthinkable—Builds a Mall”

paywall, these excerpts via Zerohedge

“With Malls In Full Meltdown Mode, GGP Goes All-In With $525MM Connecticut Mega-Mall”

*

Retail Availability Rates, US, 2016

2005 7.4%

2006 8.1%

2007 9.0%

2008 10.8%

2009 12.6%

2010 12.9%

2011 12.9%

2012 12.5%

2013 11.7%

2014 11.0%

2015 10.7%

2016 10.2%

2017p 10.1%

2018p 10.0%

2019p 10.1%

Excerpts:

The oft-reported demise of the retail sector was another topic tackled by the panelists. But they were not ready to sign on to the prevailing attitude that retail is in steep decline. “Store growth continues on a net basis,” Ludgin said.

The forecast found economists equally optimistic about the retail sector. Vacancy rates (see above) are expected to hold steady at about 10 percent for the next two years, while rental rate growth will decline from 2.7 percent to 2.0 percent in 2018—still above historic averages, the economists predict.

Though the panelists agreed that many elements of the retail sector will continue to struggle—in particular, certain suburban malls—others will see an uptick, especially as the link grows between retail and distribution space. Retail space can play a key role in solving the “last mile” issue.

“The store is just a way to deliver goods to people,” Ludgin said. “You may not need the same square footage, but the store is not dead. . . . It’s performing a somewhat different function than in the past.”

Retail space linked to services and entertainment space is still performing well, Conway said. “What we’re not seeing is addition of shop space,” he said. Suburban malls will have to deal with obsolete space, but many retail spaces will evolve, as we “see the convergence of retail and industrial into one,” he said.

Many online retailers, including Amazon, are starting to invest in brick-and-mortar space, Ludgin noted. And discount department stores “remain extremely viable and are still opening stores,” including chains like T.J. Maxx and Nordstrom Rack, which offer a value proposition. “As a nation, we still like department stores, and we still shop in them. It’s just that they are less in regional malls and more in open-air centers,” Ludgin said.

Centers focused on local interests and artisan wares are also performing well, Reagen added. “There is a huge shift in people wanting something different,” she said. “These are centers that will remain viable.”

SRC:

Urbal Land Institute, citing CBRE, April 2017

“ULI Forecast Calls for Moderate Growth for Most U.S. Real Estate Sectors”

*

2015 Summary from research firm CBRE:

Across major U.S. metropolitan areas, completions of new shopping centre space increased in 2015 and the pipeline of new projects grew. In 2015, 13 significant centres were delivered in the cohort of major metropolitan areas, compared to only six in 2014. Lifestyle centres comprised the majority of deliveries, both in terms of the number of centres and their area; the largest of these was the Village at Westfield Topanga (54,812 sq m) in the San Fernando Valley of Los Angeles. The greatest numbers of new shopping centres were delivered in Texas, with three in Houston and two in Fort Worth. [p.6]…

Within the U.S. there are now 15 major projects under construction up from nine in 2014. The most activity remains concentrated in the New York City metropolitan area, fuelled by the massive American Dream at Meadowlands, which is being developed by the owners of the largest mall in the United States – Mall of the Americas in Minnesota; the centre includes an indoor ski slope, among other attractions. Other projects in the city are smaller, but have a very high profile: The World Trade Center shopping centre in downtown Manhattan, operated by Westfield, and The Shops and Restaurants at the Hudson Yards, a huge new mixed use project developed by Related and Oxford on the West side of Manhattan, and City Point, a mixed use development in downtown Brooklyn (Acadia). Houston has four significant projects under construction, totalling 143,943 sq m. The 15 shopping centres under construction are broadly diversified among new lifestyle centres, super-regional and regional malls and power centres. Generally centres in the U.S. are opening with upwards of 90% occupancy rates. [p.10]

src:

CBRE, Q2 2016

“Global Shopping Centre pipeline rises while overall completion levels start to slow”

*

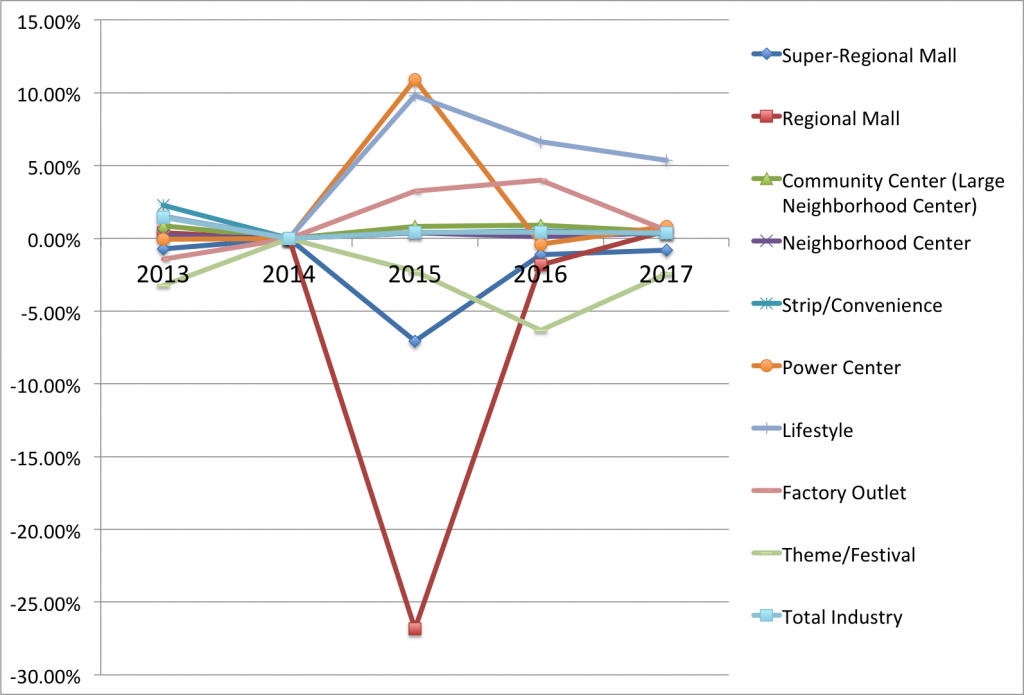

US Shopping Center Rates of Growth, 2013-2017

src:

CC’s calculation of growth based on ICSC data. See OF-charts.xls, “Shopping-Centers” tab.

2017 data:

ICSC, Jan 2017

“U.S. Shopping-Center Classification and Characteristics”

2016 data: 2016 Internet Archive version of above

2015 data: 2015 Internet Archive version

2014 data: 2014 IA version

2013 data: ICSC, 2014 Economic Impact of Shopping Centers

2012 data: ICSC, 2013 Economic Impact of Shopping Centers

Definitions

GLA: gross leasable area

square footage and industry share data below refer to January 2017

Super-Regional Mall

Similar in concept to regional malls, but offering more variety and assortment.

Avg size: 1,255,382 sq ft

% Share of Industry GLA: 10.2%

Regional Mall

General merchandise or fashion-oriented offerings. Typically, enclosed with inward-facing stores connected by a common walkway. Parking surrounds the outside perimeter.

Avg size: 589,659 sq ft

% Share of Industry GLA: 4.7% (Jan 2017)

Community Center (“Large Neighborhood Center”)

General merchandise or convenience- oriented offerings. Wider range of apparel and other soft goods offerings than neighborhood centers. The center is usually configured in a straight line as a strip, or may be laid out in an L or U shape, depending on the site and design.

Avg size: 197,509 sq ft

% Share of Industry GLA: 25.4%

Neighborhood Center

Convenience oriented.

Avg size: 71,827 sq ft

% Share of Industry GLA: 30.8%

Strip/Convenience

Attached row of stores or service outlets managed as a coherent retail entity, with on-site parking usually located in front of the stores. Open canopies may connect the store fronts, but a strip center does not have enclosed walkways linking the stores. A strip center may be configured in a straight line, or have an “L” or “U” shape. A convenience center is among the smallest of the centers, whose tenants provide a narrow mix of goods and personal services to a very limited trade area.

Avg size: 13,218 sq ft

% Share of Industry GLA: 12.0%

Power Center

Category-dominant anchors, including discount department stores, off-price stores, wholesale clubs, with only a few small tenants.

Avg size: 438,626 sq ft

% Share of Industry GLA: 13.0%

Lifestyle

Upscale national-chain specialty stores with dining and entertainment in an outdoor setting.

Avg size: 335,852 sq ft

% Share of Industry GLA: 2.2%

Factory Outlet

Manufacturers’ and retailers’ outlet stores selling brandname goods at a discount.

Avg size: 238,060 sq ft

% Share of Industry GLA: 1.2%

Theme/Festival

Leisure, tourist, retail and service-oriented offerings with entertainment as a unifying theme. Often located in urban areas, they may be adapted from older–sometimes historic–buildings and can be part of a mixed-use project.

Avg size: 147,791 sq ft

% Share of Industry GLA: 0.3%

Airport Retail

Consolidation of retail stores located within a commercial

airport

Avg size: 249,240

% Share of Industry GLA: 0.2%

src:

ICSC (International Council of Shopping Centers), January 2017

“U.S. Shopping-Center Classification and Characteristics”

***

Trends in Chinese Mall Offerings

Wall Street Journal, Jan 2017

“China Has Too Many Shopping Malls”

CC’s summary:

In 2015, 3.7 million square meters of shopping space was under construction in Chongqing — more than anywhere else in the world (and 10x the retail construction in New York). It’s also a much greater shopping stock than what’s found in China’s four first-tier cities (eg: Beijing, Shanghai) — more than 2 square meters per urban consumer, compared with 0.5sq.m in the first-tier cities. This is a problem because new demand has not been as strong as anticipated (as shoppers leapfrog stores and go directly online). The retail vacancy rate has been rising in many Chinese cities. Some department stores are reporting sharp losses, with some closing in the past year. Some retail developers are including entertainment (hotels, aquariums, sports hubs with rock-climbing, ziplines, indoor surfing, ski slopes) as well as shopping in hopes of staying ahead.

*

Financial Times, November 2017

“China’s high street finds growth alongside ecommerce”

Excerpts:

[Chinese] ]Mall operators have responded to the ecommerce onslaught by reducing space devoted to retail and increasing allocations for restaurants, cinemas and outlets offering extracurricular classes for children. Electronics retailers have added in-store experiences and reallocated floorspace for ecommerce distribution.

In 2016, Shanghai’s Joy City mall installed a gigantic Ferris wheel on its top floor to attract customers.

Gome, an electronics store which is Chinas second largest brick-and-mortar retailer by sales, has added experience-enhancing elements in stores, such as virtual reality zones. It’s offline sales grew 10.5% in the first half of the year.

*

KK: HERE IS A BIG RESEARCH REPORT ON WHAT’S NEW IN CHINESE RETAIL. YOU MIGHT LIKE TO SKIM. THINGS THAT CAUGHT MY EYE:

“NEW RETAIL”

buzz phrase in China’s retail sector, refers to retailers with large physical stores reinventing and transforming their business models and formats. Leveraging Internet, VR, AR etc to offer experience- and lifestyle-driven opportunities.

“CEWEBRITY ECONOMY”

Cewebrities are people who become famous on the Internet. Leveraging the power of their fans and social media, many cewebrities, especially fashion cewebrities, have set up online stores to sell fashion items. Some have even launched their own brands.

RURAL E-COMMERCE

The rural online retail market has become a new growth engine with the near saturation of the urban online market. Rural consumers prefer shopping online because of the less developed retail infrastructure in rural areas. … Recognizing the ample growth potential of the rural e-commerce market, increasing numbers of leading retailers and e-commerce players have adopted various “going rural” strategies. For instance, Alibaba has introduced a partnership program in rural areas. Some 20,000 partners were recruited to teach and help rural residents buy online. At the same time, JD.com has made substantial investment in rural areas to expand “last-mile” delivery capabilities; for example, it has tested drone delivery services in some remote rural areas

src:

Fung Business Intelligence, March 2017

“Spotlight on China Retail”