Refractive Surgery

Summary

Refractive surgery (corrective eye surgery) includes PRK, LASIK, and SMILE procedures, among others.

Market Scope is a research firm that collects data on LASIK procedure rates, and seems to be the primary (if not the only) source for such data. I’ve found an 18-year dataset, 1996-2014 (the last two-years of which were forecast). I’ve contacted Market Scope to inquire if they have long-term forecasts as well.

No US forecasts obtained yet. The best academic paper addressing refractive surgery forecasts (in China) suggests that procedure rates are fairly stable in the US.

Research Excerpts

As of 2011, more than 11 million LASIK procedures had been performed in the United States.

Src:

Dan Lindfield and Tom Poole. 2013 February. “Nd:YAG Treatment of Epithelial Ingrowth.” Cataract & Refractive Surgery Today Europe.

Citing Market Scope.

*

Number of LASIK (laser-assisted in situ keratomileusis) surgeries in the United States from 1996 to 2014 (in 1,000s).

Src:

Market Scope via Statista

(source inferred via other sources quoting the same numbers and attributing to Market Scope. Statista hides their name behind a paywall)

*

In 2012 U.S. procedure volumes were approximately 700,000 procedures per year. The average price point of $1500 per eye in the United States factors to a total U.S. market size of $1.05 Billion / Year.

The model for potential market growth is based on the observation that the laser refractive surgery market in the United States demonstrated saturation at approximately 2.7% penetration, and showed a baseline volume at approximately 1.2% penetration. In this context, market penetration is defined as annual procedure volume compared to the potential candidate pool.

Potential U.S. Candidate Pool = Overall Population (310 Million People)

x Patients in Treatable Age Group of 18 to 45 Years (36.5%)

x Patients with Treatable Refractive Errors (50%)

x Patients with Adequate Disposable Income (50%)

EQUATION 1: General estimate of United States candidate pool for laser refractive surgery. The result calculates to 28.3 million people.

Laser refractive surgery volumes in the United States grew steadily to peak in 2000 at about 1.5 million procedures (eyes). Volume declined during the economic downturn that began in Q4 2001 and rebounded slightly from 2003 through 2007. The U.S. market has not recovered following the macroeconomic downturn of 2008. It stood at approximately 700,000 procedures in 2012. [Citing Market Scope figures given above.]

Src:

Guy Kezirian, et al. 2013. “Forecast of Laser Refractive Surgery in China: 2013-2023.” Northwestern University Kellogg School of Management. Pages i, iii, Figure 1.

Dr. Kezirian (info@surgivision.net) is a board certified and sub-specialty trained ophthalmologist. His company has run several FDA studies for excimer laser approvals. He is an industry consultant in ophthalmology through his company, SurgiVision Consultants.

Email inquiry sent 10/9 seeking recent figures and U.S. forecasts.

*

Ron Krueger, MD, of the Cleveland Clinic in Cleveland, Ohio, discusses his forecast for the future of LASIK procedures.

LASIK will probably be replaced by something else in the next 10 years due to flap complications, biomechanical concerns, dry eye concerns.

SMILE procedure (or something like it) will probably replace it.

Src:

Mark Kontos and Ron Krueger. 2014. “Will LASIK Still Be Kind in 2025?” Aspen 2014. American-European Congress of Ophthalmic Surgery. Eyetube.net.

*

Professional Organizations (inquiries sent 10/13)

American-European Congress of Ophthalmic Surgery

contact form

American Society of Cataract and Refractive Surgery

media inquiries form

Outpatient Ophthalmic Surgery Society

Kent L. Jackson, Executive Director, kjackson@ooss.org

American Academy of Ophthalmology

media@aao.org

Update

Trudy Larkins, Executive Direction of AECOS, says:

I think Dave Harmon and Bill Freeman of MarketScope are your best resources.

Since these procedures are elective (i.e. not covered by any type of medical insurance), figures have historically been “best estimates.”

Toric IOLs are extremely popular and perhaps the most widely used. The patient pays out of pocket and the surgeon is able to significantly reduce the amount of pre-op as well as post-op (surgically induced) astigmatism.

We had hoped that having LASIK would become as anticipated as getting braces on your teeth. Unfortunately, this did not happen and some bad PR apparently resonated much more than we anticipated.

I would suggest that you contact someone from the American Refractive Surgery Council. AECOS is an Advisor to this group which is made up of industry as well as refractive surgery physicians. I do know that Richard Lindstrom MD, Eric Donnenfeld MD and Kerry Solomon MD are all very actively involved in this organization and would be great to interview.

CC emailed Dave Harmon at Market Scope directly (10/16/15)

Prosthetic Limbs Forecast to 2050

Summary

In searching for prosthetic device usage rates and forecasts, I’m finding that the most accessible type of data available describes incidence of limb loss and associated prostheses. Data describing usage rates for other types of prostheses and assistive devices has been harder to find (for example, dental prostheses, cochlear implants, artificial heart valves, etc). This summary and set of excerpts focuses on limb loss and associated prostheses.

The CDC, via its National Health Interview Survey, collected data on the number of people using upper and lower limb prostheses. Data was collected in the mid 1990s – I’m not sure if CDC has more recent (or older) figures. (Email inquiry on Oct 6, 2015. No reply as of Oct 8.)

The US Department of Health and Human Services has documented rates of amputation in the US via its Healthcare Cost And Utilization Project (HCUP), although this effort does not document rate of prostheses usage. Estimated rates of prosthesis usage by amputees vary widely.

The National Commission on Orthotic and Prosthetic Education (NCOPE) has published a workforce demand study forecasting prosthesis user figures through 2020. An academic study has forecast amputee figures to 2050. We could apply the usage rate used in the NCOPE study to extrapolate a number of users from that second study.

*

Follow-up Notes

CC emailed CDC. CC emailed reps from SFB’s Devices & Materials Committee and BMES’s Medical Devices Special Interest Group (including someone from FDA).

Donna Lochner (FDA) is not aware of any centralized repositories for overall prosthetics data, but she made a few suggestions by email: check the Center for Medicare and Medicaid Services (CMS) for the Medicare population, and individual registries by product areas (eg: INTERMACS for mechanically-assisted circulatory support devices; the Society for Thoracic Surgeons and the American College of Cardiology for transcatheter heart valves). Lochner thinks the highest volume implants are intraocular lenses, and this might be an area where CMS data would capture the vast majority of the implants.

Emailed William Polglase of CMS for assistance in interpretting data (10/15).

Emailed Medtech Solutions (recommended by BMES) to ask about general tallies.

Research Excerpts

Currently, there are an estimated 1.9 million people living with limb loss in the United States, almost half of whom are non-white. At its peak, an estimated 185,000 amputations occurred in 1996 in the United States.

Amputation rates in the total population (including individuals without diabetes, or with peripheral artery disease alone) are not known and active surveillance efforts do not exist.

Src:

Limb Loss Task Force/Amputee Coalition. 2012. “Roadmap for Preventing Limb Loss in America: Recommendations From the 2012 Limb Loss Task Force.”

*

82% [of amputations] are due to Peripheral Vascular Disease and Diabetes. More than 65 percent of amputations are performed on people age 50 and older.

While diseases such as diabetes and peripheral vascular disease are the leading causes of amputation, accidents and war continue to play a major role in driving the limb prosthetics market.

Technological growth and an increasing consumer base of amputees are bolstering the prosthetics market growth, according to an analysis from the business and research consulting firm Frost & Sullivan. The overall prosthetics market in the United States earned revenues of $1.45 billion in 2006 and estimates that number to reach $1.85 billion by 2013. The global dental prosthetics market is estimated to exceed $5 billion. Hip and knee replacements are big drivers of the orthopedic prosthetic market. Over 100,000 cochlea implants are currently in place globally. The limb future prosthetics devices and the accompanying services market are estimated to exceed $5 billion (of which an estimated $3 billion alone is in amputee patient services) in the U.S.

The lack of common standards, a common lexicon and common data collections negatively impact on the ability to assemble precise market data on limb prosthetics. A National Institutes of Health study concluded, “For example, documented rates of prosthesis use vary from 27 to 56 percent for upper-limb amputation (ULA) and from 49 to 95 percent for lower-limb amputation (LLA). A number of studies have attempted to identify variables that explain inconsistent use rates and identify persons less likely to wear and benefit from a prosthesis. Unfortunately, the existing literature is equivocal and limited by a number of factors.”

Research at the Bioengineering Institute of Worcester Polytechnic Institution, University of Utah, University of Washington and the University of Illinois at Chicago are current leaders in osseointegration and limb transplantation research.

Among the sources for this market analysis are:

Walter Reed Army Medical Center

Henry Jackson Foundation

Amputee Coalition of America

O&P Edge

The Press-Enterprise

Frost & Sullivan

Securities and Exchange Commission

Boston Globe

Aetna Insurance

Atlas of Prosthetics

National Institutes of Health

Disabled-World.com

One Source

ArmDynamics.com

some of the above tallies are from:

Persons Living with Limb Loss, 1996

National Health Interview Survey, Vital Statistics Report, Series 10, No. 200.

New Cases of Limb Loss, 1996

Health Care Utilization Project National Inpatient Sample (HCUP-NIS), 1996.

It is estimated that approximately 199,000 persons in the U.S. were using an artificial limb in 1994, with the majority using an artificial leg or foot (173,000).

Datasource: National Center for Health Statistics,

Disability Report. Table 1

EMAILED nhis@cdc.gov TO SEE IF ITS BEEN UPDATED

Src:

Dr. Grant McGimpsey and Terry C. Bradford. “Limb Prosthetics Services and Devices” [White paper]. Bioengineering Institute Center for Neuroprosthetics, Worcester Polytechnic Institution.

*

The total number of persons with an amputation, and those using a prosthesis, is expected to increase by at least 47% by the year 2020.

The projected number of persons with amputations (excluding tips of fingers and toes) is based on rates by age group and sex determined in the 1993 Health Interview Survey. These projections (Table VII) assume that the rates will remain stable through the year 2020. The total number of persons with an amputation is expected to increase by 47% between 1995 and 2020. Of the total number of persons with amputations it is estimated that 75% use a prosthesis. The population using a prosthesis is also anticipated to increase by 47% during this time period. With the advent of improved prosthetic designs and lighter materials it is likely that the rate of use may increase, particularly if third party payers become more aware of the benefits of these products.

Table VII

Projected Number of Persons with Absence of Extremities

(excluding tips of fingers and toes) 2000-2020

Year — Total Number — No. Of Users of Prostheses*

2000 — 1,752,838 — 1,314,629

2005 — 1,904,035 — 1,428,026

2010 — 2,065,993 — 1,549,495

2015 — 2,224,022 — 1,668,017

2020 — 2,382,413 — 1,786,810

*Based on 75% of total numbers of persons with amputations.

Src:

Caroline C. Nielsen. 2002 May. “Issues Affecting The Future Demand For Orthotists And Prosthetists:Update 2002.” National Commission on Orthotic and Prosthetic Education

Citing:

Benson, V and Marano, MA. Current Estimates for the National Health Interview Survey, 1993. National Center for Health Statistics. Vital Health Statistics 10 (190). 1994.

Estimated number of persons with an amputation using a prosthesis (75%) estimated from data in 1) Current Estimates for the National Health Interview Survey, 1993 ; 2) Scremin, A.M. et al. Effect of Age on Progression Through Temporary Prostheses After Below-Knee Amputation. Am. J. of Phys. Med. and Rehab, 1993, and 3)Nielsen, C.C. A Survey of Amputees: Functional Level and Life Satisfaction, Information Needs and the Prosthetist’s Role, JPO, 1991.

NOTE: An updated version of this report was produced for NCOPE in 2015, but it does not provide estimates for the number of prosthesis users. (Instead it calculates the number of O&P doctors in demand.) I’ve written to the author to inquire if that data is available. The updated report is:

Joan E. DaVanzo, Audrey El-Gamil, Steven Heath, et al. 2015. “Projecting the Adequacy of Workforce: Supply to Meet Patient Demand.” National Commission on Orthotic and Prosthetic Education. p.17, Exhibit 5 – 2014 figures. p.19, Exhibit 6 – 2016, 2025 projections.

*

In the year 2005, 1.6 million persons were living with the loss of a limb. It is projected that the number of people living with the loss of a limb will more than double by the year 2050 to 3.6 million.

Table 3

Projected Prevalence of Limb Loss by Etiology and Age (in thousands)

Year — Total

2005 — 1,568

2010 — 1,757

2020 — 2,213

2050 — 3,627

…Most striking, however, are the projected trends for the number of people living with the loss of a limb. This increase is related to the aging of the population and the associated increase in the number of people living with dysvascular conditions, especially diabetes. The prevalence of diabetes in the United States is projected to nearly double by the year 2030 solely because of changes in the demographic composition of the population. Our estimates of limb loss reflect, and indeed magnify, these trends. Even assuming that age-, sex-, and race-specific rates of both diabetes and diabetes-related amputations remain unchanged, the number of people with diabetes who are living with the loss of a limb will nearly triple by the year 2050. Overall, the prevalence of limb loss will more than double from 1.6 to 3.6 million people. Given the increase in the prevalence of obesity and the known relationship between obesity and diabetes, a projected increase in the incidence of amputations secondary to dysvascular conditions is likely.

…A goal of Healthy People 2010 is to reduce the number of lower-extremity amputations in persons with diabetes by 55%, from 4.1 per 1000 to 1.8 per 1000 persons.

Src:

Ziegler-Graham K, MacKenzie EJ, Ephraim PL, et al. 2008. “Estimating the prevalence of limb loss in the United States: 2005 to 2050.” Archives of Physical Medicine and Rehabilitation, 89(3).

*

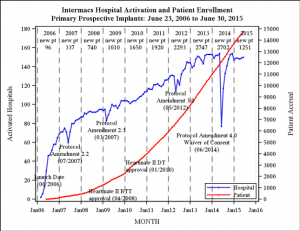

UPDATE 10/27: INTERMACS confirmed tallies for ventricular assist devices from 2006-2015. They estimate that their figures cover 90-95% of the market.

[click for larger]

Annual new patient tallies are at the top of the chart area.

2030 Injury Scenarios

Quantitative injury rate forecasts have been somewhat scarce (short of Pardee’s long-range fatality forecasts to 2100). During the search, I came across the previously mentioned Institute for Alternative Futures’ Public Health Scenarios 2030. Here’s expected scenario from their “Injury Prevention Driver Forecasts”:

- Technological innovations in design and monitoring – and decreased public tolerance – reduce unintentional injury rates for certain types of injuries

- Rates of violence continue to be closely tied to poverty, race, education, and geography

- Some innovative programs prove successful locally but are leadership-dependent and unsustainable

- Injury-related fatalities decrease but injury-related costs – including long-term care and benefits – rise due to inadequate focus on primary prevention

- Political and cultural opposition to a population-based approach hinders the most effective local policies from being embraced on a nationwide level

Src: “Injury Prevention Driver Forecasts.” 2014. Institute for Alternative Futures.

Injuries Data

Current injuries data is collected by two federal agencies, the Centers For Disease Control, and the Bureau for Labor Statistics. The CDCs data describes overall injury rates (fatal and nonfatal) going back to 2002. BLS’s data describes work-related injury and illness rates (fatal and nonfatal) going back to 1992 (only 2003 for nonfatal incidents).

The Pardee Center for International Futures produces the most long-ranging forecasts for injury- and illness-related fatalities that I’ve found so far. (As far as I can tell, their forecasts do not included non-fatal incidents.) I’ve taken samples of their data from the top of the decade through 2050, but annual data are available from 2010 through 2100.

Data from all three sources (CDC, BLS, and Pardee) are aggregated in this Google Spreadsheet:

This graphic from a 2011 Pardee paper shows the general trend in fatalities due to injuries versus disease:

Src: Barry B. Hughes, Randall Kuhn, Cecilia M. Peterson, et al. 2011. “Projections of global health outcomes from 2005 to 2060 using the International Futures integrated forecasting model.” Bulletin of the World Health Organization.

Public Health Scenarios 2030

I’ve been looking for illness-related forecasts and historic statistics for the last couple days. After looking through so much quantitative data (my roundup is here), it’s interesting to finish out the research with a look at some scenarios.

The Institute for Alternative Futures (co-founded by Alvin Toffler in 1977), has a series called Public Health 2030. The “Chronic Disease Driver Forecasts” is of particular interest.

Excerpt:

Forecast Summaries

Expectable: Chronic disease epidemic continues its upward trajectory

• Tobacco use and cancer incidence rates drop

• Aging yields higher rates of dementia and prostate and breast cancer

• Highest-risk populations cannot access new treatments for chronic disease

• Behavioral health programs show varied success/failure rates

• Primary prevention efforts are met by various obstacles, including legal and public relations battles

• About 48 percent (171 million) of U.S. residents live with one or more chronic conditions, i.e., 2% or

30 million people more since 2010

• National health spending accounts for 22 percent of GDP (compared to 18 percent in 2010)Challenging: Chronic disease epidemic escalates

• Improved access to care leads to substantial increase in diagnosed chronic diseases. Widespread

provider shortages and inconsistent quality of self-management support fail to effectively control

and prevent chronic disease

• A major economic downturn worsens psychological and behavioral health; smoking, obesity, heart

disease, cancers, and diabetes become more prevalent among both youth and elders

• Health disparities increase and low-income and minority groups are blamed for their health

problems and scapegoated for overburdening the health care system

• Some communities experience successes in improving behavioral and community health, but most

struggle to replicate this success

• Over half the U.S. population lives with one or more chronic conditions, and all states have obesity

rates above 50 percent

• Cuts in Medicare and Medicaid reduce health spending to 17 percent of GDP as many in the U.S.

forego careAspirational: Widespread conquering and prevention of chronic disease

• Communities address social determinants of health, prevention, and behavioral health; Community

Centered Health Homes are prominent

• Accountable Care Communities (ACCs) expand on the idea of the Accountable Care Organization

(ACO) to coordinate across a range of sectors, including employment, housing, transportation, and

education

• “My code is your code”: apps are tailored and reworked to engage the public in promoting personal

and community wellbeing among neighbors and localities; widespread use of personalized health

informatics, games, and digital agents to assess and change behavior

• People and groups increasingly advocate for healthier community environments

• Less than 40 percent of the U.S. population is living with one or more chronic conditions

Src: “Chronic Disease Driver Forecasts.” 2014. Institute for Alternative Futures.

Supplement Usage Prevalence

Usage Trends

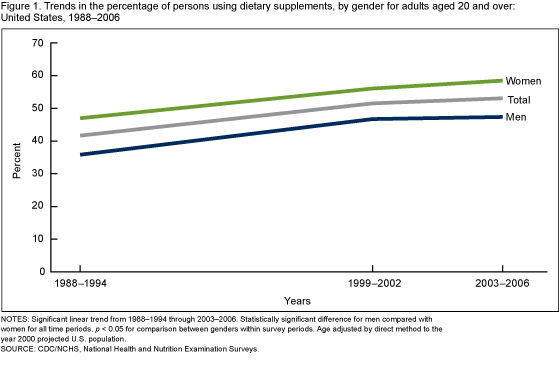

The CDC tracks U.S. dietary supplement usage (which includes multivitamins and multiminerals) via its National Health and Nutrition Examination Survey (NHANES), which began in the 1970s. In 2011, the CDC said over half of U.S. adults were taking dietary supplements.

Overall usage trend:

Usage prevalence percentages for adults over 20:

| Year | Men | Women |

| 1971-1975 | 28% | 38% |

| 1976-1980 | 32% | 43% |

| 1988-1994 | 35% | 44% |

| 1999-2000 | 47% | 56% |

| 2003-2006 | 47% | 59% |

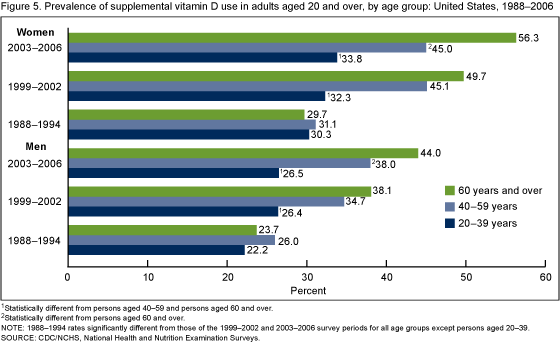

Vitamin D use by age group and gender:

Srcs:

Gahche J, Bailey R, Burt V, et al. 2011. “Dietary Supplement Use Among U.S. Adults Has Increased Since NHANES III (1988–1994).” NCHS data brief, no 61. Hyattsville, MD: National Center for Health Statistics.

Madison Park. 2011 April 13. “Half of Americans Use Supplements.” CNN.

Market Research

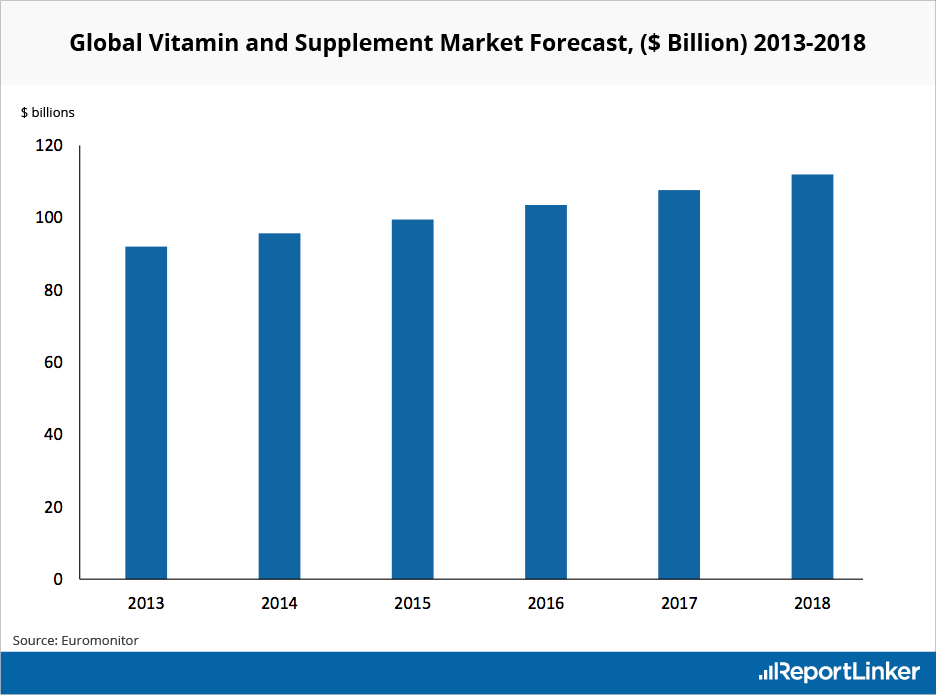

Euromonitor tracks the vitamins and dietary supplements (VDS) market. In 2013, they estimated that the market would grow at a CAGR of 4% between 2013 and 2018 to reach $112 billion in 2018.

Src:

Euromonitor (via Reportlinker). 2013. “Global Vitamin and Supplement Industry Overview.”

Per Capita Rx Usage

Current data

Evaluate and IMS Health both track current and recent rates of drug prescription per capita.

From Evaluate:

2011: 10

2013: 9

src: 2013. Evaluate. Medical Expenditure Panel Survey. Spreadsheet shared by email, 2015 Sep 10.

From IMS Health:

2010: 11.46

2011: 11.33

2013: 12.2

2014: 2.1% more than 2013

Src (2010, 2011): 2012. IMS Institute for Healthcare Informatics. “The Use of Medicines in the United States: Review of 2011.″

Src (2013): 2014. IMS Institute for Healthcare Informatics. “Medicine use and shifting costs of healthcare: A review of the use of medicines in the United States in 2013.″

Src (2014): 2015. IMS Institute for Healthcare Informatics. “Medicines Use and Spending Shifts: A Review of the Use of Medicines in the U.S. in 2014.″

Michael Kleinrock, of IMS, explains via email that Rx usage rates have been very consistent for a very long time. Their data goes back to the early 90s, but the collection of age-band data is a relatively recent addition. They haven’t yet produced harmonized figures showing all of their historic data.

Forecast data

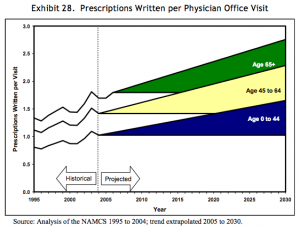

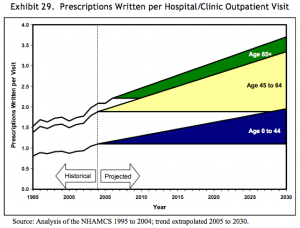

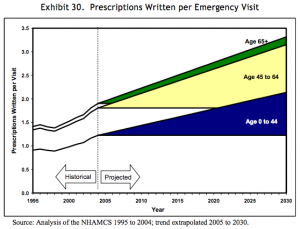

In 2008, a paper published by the Department of Health and Human Services gave forecasts for prescriptions dispensed per visit to the year 2030. Three forecasts were made for prescriptions per physician office visit, per hospital/clinic outpatient visit, and per emergency visit. The forecasts are divided into age bands for patients aged 0-44, 45 to 64, and 65 years and older. The forecasts are all based on analysis of the CDC’s National Ambulatory Medical Care Survey (NAMCS) from 1995 to 2004, with trend extrapolation from 2005 to 2030.

Src: 2008. Department of Health and Human Services. “The Adequacy of Pharmacist Supply: 2004 to 2030.” Exhibits 28-30, pp 31, 32.

Dental Braces Usage

Statistics describing dental services and usage rates are collected as part of the previously cited Medical Expenditure Panel Survey (MEPS topics: Dental Visits/Use/Events and Expenditures). Unfortunately, the publications that summarize this data often do not include procedure-level details, but instead focus on dental expenditure on the whole as a percentage of health spending.

One exception I’ve found is a paper from 2007 comparing detailed statistics from 1996 and 2004. Here are relevant excerpts:

The total number of procedures increased from about 496 million in 1996 to about 572 million in 2004.

Distribution of dental procedures1996 2004 Diagnostic 40.2% 42.5% Preventive 29.0% 30.4% Restorative 8.2% 6.9% Prosthetic 7.3% 6.4% Oral surgery 4.1% 3.3% Periodontic 0.9% 0.9% Endodontic 2.1% 1.7% Orthodontic 6.8% 6.9% Other* 1.5% 1.0%

Diagnostic includes exams and x-rays.

Preventative includes cleanings, flouride, sealants and recall visits.

Restorative includes fillings and inlays.

Prosthetic procedures include crowns, bridges, and dentures.

Periodontic procedures include gums.

Endodontic procedures include root canals.

Orthodontic procedures include braces.

Other includes any other dental service not included above.

Src:

Richard J. Manski and Erwin Brown. 2007. “Dental Use, Expenses, Private Dental Coverage, and Changes, 1996 and 2004.” Agency for Healthcare Research and Quality, Rockville, MD.

Co-author Richard Manski (rmanski AT umaryland DOT edu) has written a couple of foreward-looking papers for RAND. I’ve emailed him to ask if he is aware of any ~10-year forecasts for dental braces usage.

EDIT: Manski is unaware of any forecasts.

Dental raw data from the on-going MEPS survey is available here: MEPSnet/HC Trend Query. Raw data for orthodontic visits in 2012 is here, for example: 2012 Full Year Person-Level File. DVGEN12 – # GENERAL DENTIST VISITS 12. Assistance in interpreting the data would be helpful.

Primary Care Office Visits in 2025

“Driven by population growth and aging, the total number of office visits to primary care physicians is projected to increase from 462 million in 2008 to 565 million in 2025. After incorporating insurance expansion, the United States will require nearly 52,000 additional primary care physicians by 2025.”

Src:

Petterson, Stephen M., Winston R. Liaw, Robert L. Phillips, David L. Rabin, David S. Meyers, and Andrew W. Bazemore. 2012. “Projecting US Primary Care Physician Workforce Needs: 2010-2025.” The Annals of Family Medicine 10 (6): 503–9.

The study was based on data from the annual Medical Expenditure Panel Survey (MEPS), conducted by the U.S. Department of Health & Human Services.

In addition to the MEPS data, the CDC also produces annual estimates of physician office visits, as well as hospital visits via it’s National Ambulatory Medical Care Survey (NAMCS) as well as its National Hospital Ambulatory Medical Care Survey (NHAMCS). Tables of recent survey results are available here. We’ve not yet found a forecast for hospital visits, but we’ve aggregated NAMCS and NHAMCS figures going back to 2000 here.

Pharmaceutical Sales Through 2020

EvaluatePharma (life science market research firm) releases an annual report of current pharmaceutical sales figures with forecasts looking 5 years out.

According to the 2015 report, Novartis was the number one pharmaceutical company in 2014 and is forecast to maintain its position in 2020

Other indicators reported:

worldwide prescription drug sales (2006-2020)

regional prescription drug sales

Top 20 Companies by Rx sales in 2020

worldwide R&D spending by company

worldwide Rx drug & OTC sales by therapy area in 2020

Src: “World Preview 2015, Outlook to 2020.” 2015. Evaluate.

They also track sales volume and pricing including cost and volume per patient for the U.S. and other regions. Not available in the free report – contact them.

Media Contacts:

Evaluate and EP Vantage (for general questions)

Christine Lindgren

+1 617-866-3906

christine.lindgren@evaluategroup.com

Chempetitive Group (for U.S. media)

Rachel Wallace

+1 781-775-3640

rwallace@chempetitive.com