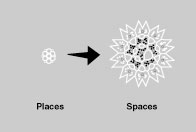

FROM PLACES TO SPACES

Making a Different Kind of Big

“Geography is dead!”

This pronouncement has become a cliche among the advocates of digitalization and telecommunications. The advent of universal and inexpensive communication is said to usher in an era where distance, place, real estate, and geography are irrelevant. The notion is only half true.

Place still matters, and will for a long time to come. However, the new economy operates in a “space” rather than a place, and over time more and more economic transactions will migrate to this new space.

Geography and real estate, however, will remain, well…real. Cities will flourish, and the value of a distinctive place, such as a wilderness area, or a charming hill village, will only increase.

Tom Peters, the perennially entertaining management guru, likes to scare the daylights out of dazed American CEOs by proclaiming, “Think of Asia, Latin America, Eastern Europe! They’re smart, fast, and cheap. And they’re next door. Your worst nightmare of a competitor is now only one-eighth of a second away!” That’s the maximum time it takes a signal to travel from one end of the globe to the other. These hungry competitors can do anything you can do, cheaper, and they all are, at most, only an eighth of a second away. In short, Peters proclaims the death of distance and the arrival of globalization.

That’s the bad news. The good news is that those geographically far away competitors will never be any closer than an eighth of a second. And for many things in life, that is too far away.

A kiss for instance. Or playing sports. Or getting to know flowers. Start-up companies selling futuristic multiplayer online games have discovered that the inherent delay in the speed of light circling the globe causes real-time experiences to fail. That noticeable gap makes no real difference in the transmission of a book order, or a weather signal, but enough of life thrives on subtle instantaneous responses that one-eighth of a second kills intimacy and spontaneity. Thus actual real-time face-to-face meetings will retain their irreplaceable value. Thus airline travel will increase as fast as online communication increases. Thus cities will endure as lag-free places where there are no one-eighth second delays.

FROM PLACES TO SPACES

People will inhabit places…

but increasingly the economy inhabits a space.

A place is bounded by four dimensions. For two things to be adjacent, they must be close to each other on one of four axes: up/down, left/right, back/forth (x, y, z), and time. As rich as physical places are (and we still don’t appreciate how rich they can be), they limit the number of connections that entities can make within them. A person in a place can only interact with a fixed and rather small number of other people in the same vicinity. Artifacts can touch only the other artifacts in close proximity.

A space, unlike a place, is an electronically created environment. It is where more and more of the economy happens. Unlike place, space has unlimited dimensions. Entities (people, objects, agents, bits, nodes, etc.) can be adjacent in a thousand different ways and a thousand different directions. A person in an electronic space can communicate to 10 million people at once, or interact in a game with 20,000 others–things that would be impossible in physical space. An automobile can be linked in hundreds of directions–to other cars stuck in traffic miles away, environmental monitors, satellite navigation antennas, toll collectors, and the manufacturer’s engine-performance center. In physical place a car can only interact with those within braking distance of its front and rear bumpers.

The invention of communication allowed life to evolve from globular organisms into fantastic beings, just as networks allow place-based firms to blossom into fantastic spaces.

FROM PLACES TO SPACES

Spaces aren’t bound by proximity.

The advantage of spaces is rooted less in their nongeographical virtuality and more in their unlimited ability to absorb connections and relationships. By means of communications, network spaces can connect all kinds of nodes, dimensions, relationships, and interactions–not just those physically close to one another.

The popular suffix of “space” is a truncated version of cyberspace, a science fiction term for an immersive electronic space. But the roots of the term are deeper. The technical concept of “space” came out of mathematics and computer science. Space is one way scientists describe complex systems; very complex spaces have their own unique dynamics. The notation of space is particularly handy when describing the ordinarily vague and indefinite form of networks. The net, as it encompasses billions of objects and agents (there are already more than 100,000 cameras on the net), operates in what mathematicians call “very high dimensions,” and has correspondingly novel dynamics. As electronic mediated environments expand, place has less influence and complex space more. As the economy infiltrates each network medium, it trades a physical marketplace for a conceptual marketspace.

FROM PLACES TO SPACES

The network economy shifts places to spaces.

In the new realm of high dimensional spaces, the network economy exhibits the following space-based behaviors.

- A different kind of bigness

- Rampant clustering

- Peer authority

- Re-intermediation

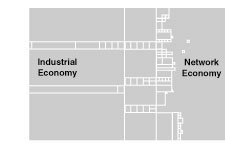

The industrial economy made it impossible to live next door to the source of all the goods consumers desired. If you wanted bananas, many intermediaries had to handle the fruit between the plantation in Honduras and your kitchen. Between the author of a book and you there needed to be a chain of editors, bankers, printers, distributors, wholesalers, and booksellers. Between you and good health care were doctors, nurses, insurance behemoths, and hospital staff. Between you and the car of your dreams stood a line of miners, smelters, engineers, manufacturers, railroad yards, showrooms, and salesmen. Each one of these agents moved the good or service along; some by completing the product (the car engineer) or customizing the service (the hospital staff), and some simply by physically moving it toward you (the banana boat). In business theory this line came to be known as the value chain. Each intermediate link in the long chain of creation added some measure of extra value, justifying the cost the link added to the good’s final price. Companies competed to insert themselves into a value chain, then to expand their control of greater lengths of the chain.

One of the very first noticeable effects of computers and networked communications was the alarming way they disrupted traditional value chains. Futurist Paul Saffo calls the multiple interactions needed to survive in the new economy a move “from value chain to value web.”

FROM PLACES TO SPACES

In the marketspace of networks, value flows in webs.

Many classic value chains were crowded with intermediaries who distributed a completed product or service. Take the banana wholesalers. Although they physically handled the product and often stored it in inventory at great cost, their primary value to the customer was informational. In theory, small bunches of bananas could be wrapped and sent directly to your home from a particular plantation with fewer intermediaries involved in warehousing and storage, and thus at lower costs. You would place an order directly to Best Bananas in Honduras for one bunch per week, except during the school holidays, and they then would mail them out to you. To do that effectively, though, would require network technology capable of a) finding a plantation you like; b) getting the right bunch to you at the right time; c) shifting to a cooperating planter if the first planter’s fruit was not yet ripe; d) tracking the account payable for such a tiny buyer as yourself; and, e) dealing with all the millions of ordinary exceptions and screw-ups that any system as complex as this would entail.

The industrial age had no technology capable of doing that, so it substituted the wholesale system for networked information. Orders were aggregated at the local produce stand, sent to a wholesaler, who aggregated them further, and relayed the combined request through various shipping intermediaries to a farmers’ coop, which distributed orders to various planters. Your personal “order” was submerged in a sea of others; the system essentially ignored it. Making their way back to you, the bananas followed a reverse chain of links, sitting in warehouses as a way to buffer the incomplete consumer information they should have had.

It may be a long while before bananas skip the industrial value chain, but other foods, higher priced and not as bulky, already can be bought this way. Food fanatics in cities anywhere can purchase specialty coffees, or authentic maple syrup, or organic beef by linking up with farmers directly and getting their goods right from the farm via the post office, or FedEx networks, bypassing the wholesale and retail intermediaries. When gourmets use web sites and direct-mail catalogs to buy directly from growers, the traditional intermediaries are taken out of the picture.

FROM PLACES TO SPACES

The banking industry was the first…

…to name this creeping displacement of intermediaries. They noticed, quite rightly, that as information technology infiltrated the banking industry, and as the industry was deregulated, nobody seemed to need banks anymore–at least not banks as bureaucratic intermediaries. You could get easier loans at Sears, higher interest from a mutual fund, and better service at an ATM. Banking functions were being “disintermediated” the bankers cried! For the typical neighborhood bank this was especially true. The disintermediation of the financial systems continues unabated; every week another bank branch shuts down.

As more commercial activities shift toward knowledge and information, the economy seems ripe for fatal disintermediation. Why should such digital age products as music CDs and news reports travel any other route except the short one that proceeds directly from the artist or author to you, the listener? Recent success stories, such as the case of Matt Drudge, give credence to a network’s inclination to bypass the middle guys. Drudge, a no-name Hollywood gossip reporter, dispatched his insider scoops directly from a bedroom computer to a growing list of web readers until he had a national readership and a national brand. Some bands, both famous and unknown, are attempting the same thing in music. The laborious tasks of stamping out disks, storing them, trucking them across country, warehousing on pallets, and then fighting for display space in a music store all seem to evaporate as network technologies make the transmission of music to fans direct and short. Big net, no middlemen, no fuss.

The potential of disintermediation, however, looms larger than the actuality at the moment, and casts a large and frightening shadow. Retailers, especially, are in a panic. If anyone can log on to the web and comparison shop for the lowest-priced refrigerator directly from the manufacturer, what’s in it for the mall stores? If anyone can order up a video from the studio, what’s in it for the local video shop? If anyone can get 5,000 sitcoms on demand, who needs NBC? The wholesalers are worried silly, but artists and creators are euphoric. The web promised (finally!) a way to beat the system of limited shelf space that stymied the debut of new novels, new albums, and new products in every type of store. With the web, there was unlimited shelf space. There was success in store for everyone!

FROM PLACES TO SPACES

When Wired magazine began developing…

…one of the very first commercial web sites in 1993, the phrase “unlimited shelf space” was often used by potential contributors. Closely linked to this phrase was “bypassing the editor”: the notion that editors were superfluous intermediaries, and that writers and readers didn’t have to be subject to the frustrating and degrading filtering of go-betweeners. The raw stuff would flow in its full length and naked power directly from writer to reader. Our first prototypes convinced us that that wasn’t how the net worked. The web site we launched and continue to build today (Wired Digital) is based on a different premise: that in a network economy, intermediaries have tremendous value.

Technology encourages the proliferation of intermediates. Smaller companies, in greater numbers, are able to find niches where niches could not have existed before.

Everything about the web, especially the over 1 million web sites currently in existence, suggests that the expectation that the network economy favors disintermediation is exactly wrong. It is quite the opposite. Network technologies do not eliminate intermediaries. They spawn them. Networks are a cradle for intermediaries.

FROM PLACES TO SPACES

Everywhere networks go…

…intermediaries follow. The more nodes, the more middlemen.

It is so cheap to complete a transaction from almost anywhere, anytime, that tiny slivers of value, built upon microcosts of transactions, can be surgically inserted into all manner of processes and products. Because each microvalue sliver is so cheap, there is economic room for multiple microvalue slivers where before there was only room for one intermediary. As transaction costs plummet to the nanopenny level, some little crumb of value can be profitably added to more and more processes.

The combinatorial mathematics of networks also boost the opportunities for intermediaries. By definition, every node on a network is a node between other nodes. The more connections there are between members in a net, the more intermediary nodes there can be. Everything in a network is intermediating something else.

FROM PLACES TO SPACES

All nodes in a network are intermediaries.

Someday everyone in the world will have email, and when they do, I don’t want six billion emails a day as everyone shares what’s on their mind. Since half the world will probably have their own businesses, and half of those will be start-ups, I will do everything I can to insert intermediaries between my mailbox and their mailsenders, to sort out, route, and filter my incoming mail. By the same token when I go to email old Mohammed Jhang, someone whom I have not met, who lives in Chinese Turkestan, to let him know about my latest gene therapy cure for arthritis, I’ll need an intermediary to find him and then to reach past his blocking filters. I probably won’t get through so I’ll need more intermediaries (An advertiser? A lottery? A locating agent?) to lure him into the open, perhaps a pigeon-racing club, or the cineplex where he gets his movies from, to make him aware of my discovery. Sure, anyone can type “new gene therapy cure for arthritis” and turn up 32,000 hits. But you need intermediaries to vouch for their medical worthiness. You need intermediaries to compare my price and the others.

The marketspace of the new economy can hold far more intermediaries than the marketplace of the old could. This swelling bulk of intermediaries becomes an exaggerated middle. As networks proliferate, so do overlapping clusters of intersecting interests that reside in the realm of the middle. In fact the hypermiddle is less a size than a shape.

FROM PLACES TO SPACES

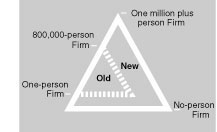

Technology has always influenced the size of…

companies. The invention of the elevator made possible high-rise buildings, which brought thousands of employees together into one tightly coupled physical space. High-rise towers launched the golden era of the centralized corporation. The advent of telephones on employee desks allowed the centralized corporation to spawn branches in neighboring cities and states, so that corporations grew in staff; at its peak in 1967 GM employed some 850,000 people in all of its factories and administration buildings.

Computers and networking technology initiated a shift in the other direction. What took 8 people before might be done now with 7 using technology. Firms that relied heavily on these technologies could reduce the number of employees. A company like Microsoft today employs a relatively meager 20,000 people.

If firms got smaller with tiny doses of networking technology, then the logical extrapolation dictated that with large doses the firm should continue to reduce until it reached one employee. Some statistics tend to confirm this drift. Counting the 14 million self-employed, the 8.3 million independent contractors, and the 2.6 million temporarily employed in the United States, there are 25 million Americans today working as a unit of one. If this trend continues for a couple more decades, in the future everyone will be a free-agent working for themselves, and our country will be a free-agent nation.

Network technology increases the size of the largest firms yet makes it more possible to have smaller firms while also increasing the number of midsize firms.

But network power cuts both ways. Although networks empower the solo practitioner, they also empower very large organizations. We are just as likely to see the rise of the Godzilla-nation as the free-agent nation. Big has not really been done yet. With the incredible place-shifting power of communication technologies, and a yet-to-be-tapped global market, the world will soon witness corporations that will dwarf the size of the old GM. One can imagine a truly global consultancy, such as Andersen Consultants or Ernst & Young, having a staff of one million worldwide.